ETF Basics

Presented by Kevin M. Curley, II, CFP®:

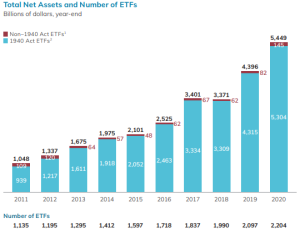

Since the first exchange traded fund (ETF) was introduced to the market in 1993, exchange-traded products have seen tremendous growth. In 2020, U.S. ETF assets have reached close to $5 trillion, with more than 2,000 exchange-traded products on the market, and an amazing growth rate of 25 percent per year. ETFs are changing the way people invest, allowing investors big and small to build institutional-caliber portfolios with lower costs, better transparency, and greater tax efficiency than ever before.

What is an ETF?

Mutual funds are pooled investment structures. That is, multiple investors put their money in a single pot and hire a manager or managers to invest it. Each investor receives shares in the fund in direct proportion to the size of his or her investment. The fund itself can buy dozens, hundreds, or thousands of securities.

An exchange traded fund is structured in exactly the same way. In fact, ETFs are mutual funds. For the most part, they are structured, managed, and regulated just like other mutual funds. The biggest difference between an ETF and a mutual fund is that an ETF trades just like a stock on an exchange. ETFs can also be sold short or traded on margin, making them flexible investment vehicles.

Total Net Assets in United States and Number of ETFs

1 The funds in this category are not registered under the Investment Company Act of 1940 and invest primarily in commodities, currencies, and futures.

2 The funds in this category are registered under the Investment Company Act of 1940.

Source: icifactbook.org

How does an ETF actually work?

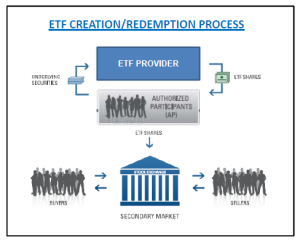

Many of the unique characteristics of an exchange traded fund stem from their creation and redemption process. When an ETF company wants to create new shares of its fund, it turns to what is called an authorized participant (AP). An AP may be a market maker, a specialist, or any other large financial institution. It is typically the AP’s job to acquire the securities that the ETF wants to hold.

For instance, if an ETF is designed to track the S&P 500 Index, the AP will buy shares in all the S&P 500 constituents in the exact same weights as the index, then deliver those shares to the ETF provider. In exchange, the provider gives the AP a group of equally valued ETF shares, called a creation unit, which is usually a block of 50,000 or 100,000 shares.

The exchange takes place on a one-for-one, fair-value basis. The AP delivers a certain number of underlying securities and receives the exact same value in ETF shares, priced based on their net asset value (not the market value at which the ETF happens to be trading). This works out well for both the ETF company and the AP. The ETF provider gets the stocks it needs to track the index, and the AP gets plenty of ETF shares to resell for profit.

The process can also work the other way if there are a large number of redemptions. APs can remove ETF shares from the market by purchasing enough of those shares to form a creation unit and then delivering the shares to the ETF issuer. In exchange, APs receive the same value in the underlying securities of the fund.

Exchange Traded Fund Features

Here are some of the features you are likely to find with ETFs.

Flexible trading. ETFs are priced and traded throughout the day, just like stocks. This gives investors control over buying and selling, allowing them to sell short, trade on margin, and place limit and stop-limit orders.

Lower expenses. ETFs track an index, which is typically less costly than active management. Active mutual funds must go to market when money moves in and out, and investors must pay a spread or commission. There is also much more recordkeeping involved in actively managed mutual funds. To buy shares of an exchange traded fund, investors simply place an order with their broker.

Tax efficiency. When a mutual fund sells securities due to redemptions or some sort of tactical move, capital gains result. ETFs avoid both of these issues. First, ETFs typically track an index and have very little turnover. Second, the creation and redemption process allows the ETF provider to deliver underlying holdings to the AP rather than selling them when faced with redemptions, thus avoiding capital gains. The ETF provider can even deliver the shares with the lowest tax basis, leaving the fund with shares that are at or above the current market value. These two features allow many ETFs to pay little or no capital gains.

Transparency. Although ETFs are not required to report their holdings to shareholders on a daily basis, they must disclose their creation and redemption baskets, which hold the securities that APs must purchase to create new shares of the ETF. Investors can also see the full holdings of the index that an ETF tracks, which provides a high level of transparency. Mutual funds, by contrast, are typically required to report their holdings only on a quarterly or semiannual basis.

Portfolio completion. Before the advent of the ETF, it was difficult for retail investors to gain exposure to some segments of the market, including commodities and other niche areas. Today, a wide array of ETFs cover numerous sectors, styles, industries, countries, and regions, allowing investors to gain exposure to diverse areas of the market.

Trading costs. As previously mentioned, ETFs trade just like a stock. The downside to this is that investors have to pay a commission each time an ETF is purchased. For investors looking to make one large lump-sum transaction, an ETF can make sense. But investing small amounts over time in an ETF can be expensive.

Bid-ask spreads. ETFs have two prices, a bid and an ask price. Investors need to be aware of the spread between the price they will pay for shares (ask) and the price a share could be sold for (bid). ETFs, especially those that are not heavily traded, sometimes have high spreads. If an ETF has a high spread, the price at which you buy or sell a security may be more or less than the intraday value of a fund.

Tracking error. Most ETFs are designed to track the performance of a particular index, but this isn’t always as easy as it sounds. ETFs sometimes stray from the performance of the intended index. This is called tracking error, and it can occur for different reasons. Unlike indices, ETFs typically hold some amount of cash. The timing of dividends can also be different. Sometimes, an index will have illiquid securities, which an ETF cannot buy.

Product complexity. For almost every segment of the market, ETF providers continue to introduce new products with exotic structures. Investors may find these products confusing. Leveraged ETFs that invest in futures contracts, swaps, and other derivatives, for instance, can be particularly complex and are subject to greater risks. If you’re interested in adding an ETF to your portfolio, be sure to seek your financial advisor’s advice to find a product that’s appropriate for you.

Exchange-traded funds (ETFs) are subject to market volatility, including the risks of their underlying investments. They are not individually redeemable from the fund and are bought and sold at the current market price, which may be above or below their net asset value.

Investors should consider the investment objectives, risks, charges, and expenses of the ETF carefully before investing. The prospectus contains this and other information about the ETF. You can obtain a prospectus from your financial representative. Read the prospectus carefully before investing.

###

Kevin M. Curley, II is a financial advisor located at Global Wealth Advisors 100 Crescent Court, 7th Floor, Dallas, TX 75201. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA / SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (214) 613-6580 or at info@gwadvisors.net.

Authored by Brian McCormick, CIMA®, CRPS®, AIF®, manager, investment management and research, at Commonwealth Financial Network®.

Check out these additional articles on the topic.

© 2021 Commonwealth Financial Network®

Back To Blog