What You Need to Know About Commodities

Presented by Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®:

This article will provide an overview of commodities as an asset class with discussion of performance drivers as well as the potential benefits and risks from an investor’s standpoint. The most commonly known commodities, such as crude oil, natural gas, and precious metals, will be discussed in more detail. Lastly, an overview of the various investment products that provide exposure to commodities will be discussed.

What is a commodity?

Commodities are raw materials that typically get used as inputs in the production of goods and services. Individual commodities are generally categorized under one of the following five sectors: energy, precious metals, industrial metals, agriculture, or livestock.

COMMODITIES AS AN ASSET CLASS

Supply and demand. Commodities are fundamentally different from traditional asset classes such as stocks and bonds. For instance, stocks and bonds are typically valued by discounting expected future cash flows to arrive at a present value. Commodities, on the other hand, are valued based on supply and demand. As a result of these fundamental differences, commodities often have low or negative correlations with stocks and bonds. In addition, individual commodities, such as crude oil, may have different supply-and-demand characteristics compared with other commodities like gold.

Inflation. Commodity prices often positively correlate with inflation because many commodities are used as inputs to produce goods and services. In addition, some commodities are components of inflation measures. For instance, the Consumer Price Index (CPI) includes the price changes of gasoline (a refined product derived from crude oil) in its computations. Therefore, an increase in gasoline prices could directly contribute to an increase in inflation.

Currencies. Commodities are typically priced in U.S. dollars. As a result, commodity prices and the U.S. dollar’s value often have an inverse relationship (i.e., negative correlation). One explanation for this relationship is that a falling dollar increases purchasing power in foreign currency terms. Conversely, a rising dollar decreases purchasing power in foreign currency terms. Classic economics suggest that demand typically increases as prices fall and vice versa.

Geopolitical risk. Commodities are natural resources that are produced globally in both developed and developing (i.e., emerging markets) countries. Developing countries generally produce a significant percentage of the global supply. In addition, production for some individual commodities is concentrated in a small number of countries. These dynamics can expose commodity prices to political instability in a country. For example, a labor strike at a platinum mine could disrupt global production, which would likely result in higher platinum prices. This event would be positive for investors in the physical commodity. It could have a negative effect, however, on investors who own shares in a natural resources company that is affected by the labor strike.

Potential benefits of investing. From a portfolio standpoint, commodities can potentially provide diversification benefits given that the asset class often has low or negative correlations with stock and bonds. Commodities can also act as a hedge against inflation during certain time periods. Lastly, commodity prices can provide a hedge against event risk. For example, extreme weather or political instability can result in higher commodity prices as these types of events could cause supply disruptions.

Potential drawbacks and risk factors of investing. Commodities produce no cash flows; therefore, commodities can be more difficult to value compared with stock and bonds. A lack of valuation metrics for the asset class can create challenges for investment managers and financial advisors when they try to measure relative valuations across asset classes. In addition, commodities produce no investor dividends or interest; therefore, the asset class can become less attractive as interest rates rise because an investor’s opportunity cost would also rise.

Lastly, individual commodities can be volatile. For instance, natural gas has historically been one of the most volatile commodities, with a standard deviation more than double that of the S&P 500. Even a more defensive commodity such as gold has historically had comparable volatility to the S&P 500. Therefore, investors may want to avoid concentration in any one commodity from a portfolio standpoint.

ENERGY COMMODITIES

Crude oil and natural gas are the two most commonly known commodities. There are no investment products, however, that effectively track the spot price of either commodity given each one’s storage challenges. (Please see Physically backed exchange-traded funds for more details.) Investment vehicles for exposure to energy commodities are limited to futures-based commodity products and natural resources equities.

Crude oil. Crude oil is a liquid-form fossil fuel that gets refined into petroleum products, such as gasoline, and distillates, such as diesel fuel and heating oil, jet fuel, petrochemical feedstocks, waxes, lubricating oils, and asphalt. Gasoline generally accounts for the largest share of crude oil consumption within developed countries. In these countries, people primarily use gasoline for transportation vehicles, including automobiles, motorcycles, boats, and small aircrafts. In developing countries, gasoline consumption generally accounts for a smaller share of crude oil consumption given lower vehicle ownership rates. Crude oil is used more heavily as a fuel for power generation in these countries.

From a supply-and-demand perspective, global crude oil demand is tied to economic activity given its high consumption in transportation and industrial uses, such as manufacturing. It has several pricing points. For example, West Texas Intermediate (WTI) is the most common crude oil benchmark in the U.S. Cushing, Oklahoma, is the delivery and price settlement point for WTI crude oil contracts. Brent is the most commonly used crude oil benchmark outside of the U.S. Brent crude oil is used to price European, African, and Middle Eastern oil that is exported to the West.

Natural gas. Natural gas is a fossil fuel that can be used as a fuel or to make materials and chemicals. Natural gas has a number of uses, including the following:

- Electric power generation

- Heating and cooling buildings

- Cooking and heating water

- Natural gas-powered automobiles

Natural gas also appears as a raw material in many products, including paints, fertilizer, plastics, antifreeze, dyes, photographic film, medicines, and explosives.

Compared with crude oil, natural gas prices tend to be more exposed to supply-and-demand fundamentals within a particular country or region rather than on a global scale. This is generally the case because natural gas is more difficult to transport across oceans. It is mainly transported by pipeline in its gas form. Transporting natural gas across the ocean, however, requires additional infrastructure to cool it into a liquid form (i.e., liquefied natural gas) using liquefaction facilities. Liquefied natural gas (LNG) is much denser than compressed natural gas, and much higher volumes of gas can be transported in liquid form. LNG travels across oceans on large shipping vessels and then returns back to a gas form after going through re-gasification facilities.

Natural gas demand tends to be seasonal given that it is heavily used to heat and cool buildings. Because of its use in heating homes, natural gas demand tends to be heaviest from December to March, so inventories typically fall and prices rise during these months. As a result of seasonality and transportation challenges, natural gas has historically been one of the most volatile commodities.

PRECIOUS METALS COMMODITIES

Precious metals prices are partially driven by supply-and-demand fundamentals like other commodities. Demand comes from jewelry, technology, and industrial applications, which can all be sensitive to the economy (i.e., cyclical). Precious metals, however, also have counter-cyclical sources of demand, such as investment. For example, investment demand for precious metals can increase during periods of heightened economic, financial, or geopolitical distress. Precious metals often act as an alternative currency or defensive asset class during these time periods.

Precious metals can also be sensitive to other macroeconomic and monetary factors, such as currency exchange rates, interest rates, and inflation. Similar to other commodities, precious metals often perform inversely to the U.S. dollar. A low interest rate or deflationary environment can have a positive effect for precious metals. A rising interest rate environment, however, can be negative for precious metals. This effect comes from the fact that precious metals do not produce cash flows or pay dividends to investors. An investor’s opportunity cost will increase as interest rates rise.

From a portfolio standpoint, precious metals may provide diversification benefits as the asset class often has low or negative correlations with stocks and bonds. Four precious metals commonly used for investment purposes are gold, silver, platinum, and palladium. Physically backed exchange-traded funds (ETFs) are available for each of these precious metals. In addition, physically backed ETFs are available for exposure to multiple precious metals. For instance, an investor could purchase one ETF that invests in all four precious metals.

Gold. Jewelry and investment purposes account for the largest portion of gold demand. Other demand drivers include technology, such as electronics, and central banks, which purchase gold as a reserve asset. Gold is used less for technology and industrial applications compared with other precious metals. Therefore, gold demand is typically less sensitive to the economy, making it a relatively more defensive precious metal. On the supply side, recycling accounts for a significant portion of global production in addition to mine production.

Silver. Compared with gold, silver has more heavy use for technology and industrial purposes, which can make it more sensitive to the economy. Silver is used as an input in industrial applications, such as electrical components, batteries, solar panels, and auto parts. Other demand drivers include jewelry, silverware, and investment purposes. Historically, silver has had a high correlation with gold and usually moves in the same direction; however, it tends to make larger movements in both directions (i.e., higher volatility).

Platinum and palladium. Platinum and palladium share similarities as a significant portion of their demand comes from automobiles. Both metals appear in the catalytic converters of automobiles because they possess chemical properties that allow them to oxidize, or burn, carbon monoxide and hydrocarbons, reducing toxic tailpipe emissions and smog. Consequently, car demand influences the price of these metals. Platinum is used for auto catalysts, spark plugs, and oxygen sensors for both diesel and electric cars. Palladium demand, on the other hand, is primarily driven by the needs of catalytic converters for gasoline-engine automobiles. These metals are also used for other industrial applications, technology, and jewelry.

HOW TO INVEST IN COMMODITIES

Physically backed exchange-traded funds. This is the most effective structure for investors seeking spot price returns. The spot price is the current price of a particular commodity, which is typically the price quoted by the media. Physically backed ETFs store the physical commodity in vaults; therefore, these products effectively track the spot price return of the underlying commodity, minus expenses.

Physically backed ETFs, however, are limited to the precious metals sector because the commodities involved can be more easily stored compared with other commodities. Physically backed ETFs do not exist for other commodity sectors, including industrial metals, agriculture, and livestock, because storing the physical commodity for investment purposes would not be practical given storage costs as well as spoilage for certain commodities (e.g., agriculture).

In addition, ETF sponsors have received pushback from regulators when they have tried to create physically backed ETFs for commodities outside of the precious metals sector. One potential concern from a regulatory standpoint is that significant investor demand for certain commodities could reduce the level of supply available for industrial purposes. Lastly, keep in mind that long-term gains on physical metals ETFs are taxed at 28 percent. For this reason, it may be more tax efficient to hold this type of investment in a qualified account.

Futures-based commodity products. Given the storage challenges associated with commodities outside of the precious metals sector, futures-based commodity products were created to give investors the ability to invest in other types of commodities. Futures-based commodity products, however, are complex products that have a unique risk-and-return profile that differs from physically backed ETFs and other asset classes.

Therefore, to manage expectations from a performance standpoint, investors need to understand how futures-based products are structured. These products are not designed to track the spot price of an underlying commodity. These products do not own or store the physical commodity—rather these products invest in derivatives, such as futures contracts or swaps. The derivative investments may require collateral, which is typically invested in bonds.

Outlined below are the three main categories of futures-based commodity products. See Futures-based products deeper dive for additional information about how these products are structured and what factors affect performance.

- Commodities broad basket funds. This category refers to mutual funds, ETFs, and exchange-traded notes (ETNs) that provide exposure to a diversified portfolio of commodities futures contracts. These types of funds typically provide exposure to a portfolio of futures contracts diversified across the energy, precious metals, industrial metals, agriculture, and livestock sectors.Commodities broad basket funds offer investors exposure to futures-based commodity indices, such as the Bloomberg Commodity Index or the S&P Goldman Sachs Commodity Index (S&P GSCI). In addition to these two indices, there are several other commodity futures indices, and all of them can have drastically different construction methodologiesFor instance, the Bloomberg Commodity Index determines the underlying commodity weights based on a combination of futures trading activity and global production data. No single commodity sector can constitute more than 33 percent of the index. The index is typically weighted approximately one-third energy, one-third metals, and one-third agriculture/livestockIn comparison, the underlying commodity weights for the S&P GSCI are primarily based on production data. The S&P GSCI does not cap the exposure to individual commodities or commodity sectors. As a result, the index is heavily weighted toward energy commodities given the production-weighted methodologyInvestment strategies used by commodities broad basket funds can vary widely. Some funds take a passive approach to the commodity sector and individual commodity weights. For instance, a fund may seek to track the Bloomberg Commodity Index or S&P GSCI. Other funds may take a more active approach by underweighting or overweighting commodity sectors and individual commodities relative to their benchmarks.

- Commodity sector-focused ETFs and ETNs. This category refers to futures-based ETFs and ETNs that provide exposure to a specific sector, such as energy or industrial metals. For instance, a product might invest in a portfolio of energy-related futures contracts that include Brent crude oil, WTI crude oil, natural gas, gasoline, and heating oil.

- Single commodity-focused ETFs and ETNs. This category refers to futures-based ETFs and ETNs that provide exposure to a specific commodity, such as Brent crude oil, WTI crude oil, or natural gas.

Natural resources equities. This last category refers to publicly traded companies that are involved in the exploration, production, and sale of commodities. Examples include oil and gas exploration and production (E&P) companies, metals and mining companies, and agribusiness companies. Natural resources companies provide exposure to commodities because they generate revenue from the production and sale of commodities; therefore, their earnings and stock prices can be sensitive to commodity prices.

Natural resources companies, however, are not considered a “pure play” (i.e., perfect correlation) on commodity prices because a number of operational factors can affect revenues and earnings. For instance, natural resources companies often utilize hedges to protect revenues during periods of falling commodity prices. The use of hedges may limit the downside from a revenue perspective; however, hedging strategies can also limit the upside. Other factors that can affect earnings include operating expenses, such as wages, equipment, and fuel prices.

In addition, natural resources companies typically utilize debt to finance operations. The use of debt can cause natural resources companies to be a leveraged play on the spot price of the underlying commodity. In other words, the stock prices for natural resources companies can potentially be more volatile than the spot price of the underlying commodity they’re producing. Lastly, natural resources companies are publicly traded companies; therefore their stock prices can be correlated with the broader equity markets and, to a lesser extent, fundamentals during certain periods.

FUTURES-BASED PRODUCTS DEEPER DIVE

Futures contract. A futures contract is a contractual agreement to buy or sell a particular commodity at a predetermined price, which reflects the expected value of the commodity upon its future delivery. Futures contracts are traded on an organized exchange. At any point in time, buyers (i.e., long futures holder) can close their position by selling an identical position (so that the long positions and short positions net to zero). The buyer can maintain long-term exposure to commodities by purchasing a new futures contract as the contract near expiration is sold, also known as rolling futures contracts.

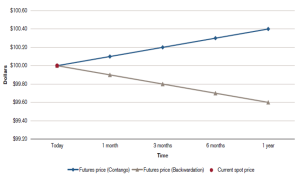

Futures curve. Futures contract prices are generally represented in the form of a futures curve, which is illustrated in Figure 1. Futures contracts can have different expiration dates. For instance, a futures contract could expire in one month, three months, six months, and so on. The shape of the futures curve for a particular commodity typically falls into one of two categories: backwardation or contango, which we will discuss in more detail later.

Figure 1. Sample Futures Curve Source: Credit Suisse

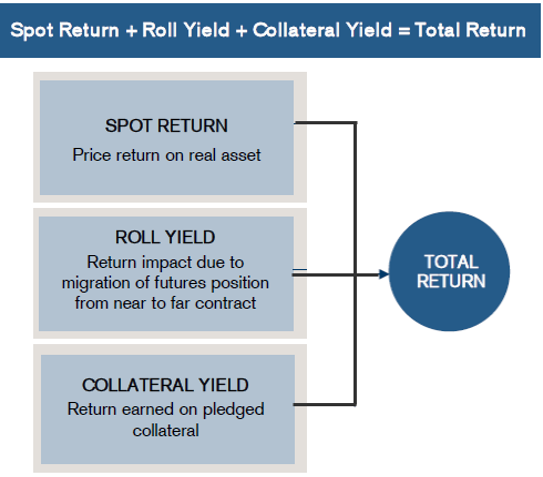

Futures contract total return components. Investors need to be aware that futures-based products are not designed to track the spot price of the underlying commodity; rather, returns are linked to the futures market. These products maintain exposure to commodities by periodically purchasing and selling futures contracts as they near expiration. This process can have a significant positive or negative performance impact on these products, which can compound over time as the holding period increases. Figure 2 illustrates the three components of return for futures contracts.

Figure 2. Source: Credit Suisse

- Spot return: The spot price return measures the price return for a particular commodity. The spot price is the current price of a commodity.

- Roll yield: The roll yield can represent a significant portion of the total return for futures-based products. It is defined as the portion of the return that results from the migration of a futures position from the near to far contract. The roll yield essentially measures the return resulting from the process of rolling futures contracts to maintain exposure. The roll yield largely depends on the shape (e.g., backwardation or contango) and steepness of the futures curve.

- Collateral yield: The collateral yield is defined as the interest earned from bonds or other money-market assets used to collateralize the futures contract.

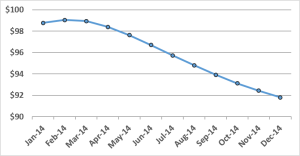

Backwardation. The term “backwardation” represents a market environment in which the futures curve is downward sloping (see Figure 3). In this type of environment, the price of a commodity scheduled for future delivery is lower than the current spot price. Backwardation typically occurs when commodity consumers are willing to pay a premium to take delivery at an earlier date, often because they need to use the commodity immediately.

Backwardation usually occurs when a particular commodity has a short-term lack of supply or very strong demand. Backwardation is generally a positive market environment for futures-based products because a futures contract can be purchased at a lower price to maintain exposure as a contract nears expiration and is sold. Keep in mind that this type of futures curve does not guarantee a positive return for futures-based products because the spot price return is an important return component as well.

Figure 3. Futures Curve in Backwardation Source: Bloomberg

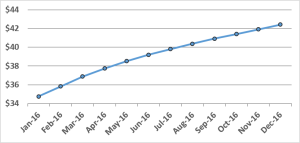

Contango. The term “contango” represents a market environment in which the futures curve is upward sloping (see Figure 4). In this type of environment, the price of a commodity scheduled for future delivery is higher than the current spot price. A market in contango encourages commodity owners to sell a futures contract at a higher price, store the commodity, and then deliver the commodity to the buyer when the futures contract expires.

Contango is a normal condition for most commodities. Higher future prices are necessary to compensate the owner’s cost to store the commodity (i.e., the cost of carry). The major components of the cost of carry include financing costs, storage costs, and spoilage. Contango in the futures market may also result from expected supply-demand imbalances or seasonality. Contango is generally a negative market environment for futures-based products because futures contracts are purchased at higher prices to maintain exposure as they near expiration.

Figure 4. Futures Curve in Contango Source: Bloomberg

Types of roll strategies. Commodities broad basket funds typically use active strategies to manage the process of rolling futures contracts. ETFs and ETNs, on the other hand, typically utilize systematic roll strategies that are based on calendar dates or determined through a rules-based process. Summarized below are the three types of roll strategies ETFs and ETNs typically use.

- Front-month: The most basic strategy is a front-month roll. This type of strategy holds the futures contract that is nearest to expiration, known as the front-month contract. As it nears expiration, the futures contract is replaced with the second-month contract.

- Laddered: The second type of roll strategy holds a series of futures contracts that expire in different months along the futures curve. For example, a futures index may hold an equally weighted portfolio of 12 different futures contracts that span across the first 12 months on the futures curve.

- Optimized: Similar to the laddered strategy, an optimized strategy holds futures contracts that expire in different months along the futures curve. In comparison to the laddered strategy, an optimized strategy uses a rules-based process to select the futures contracts that are held. Generally, products that utilize this strategy attempt to enhance the roll yield by rolling into contacts with the mildest contango or steepest backwardation.

FUTURES-BASED PRODUCTS SUMMARY

A key takeaway is that the returns for futures-based commodity products may not closely track the spot price return of the underlying commodity because of roll costs associated with futures contracts. These types of products may effectively track the spot price over time periods less than one month, depending on the product’s roll schedule. Over longer-term holding periods, however, the deviation between the futures-based product’s total return and the spot price can widen as the holding period increases due to the process of rolling futures contracts. This deviation in returns is largely driven by factors such as the shape and steepness of the futures curve, which can significantly affect these products’ performance.

COMMODITIES PRIMER FINAL THOUGHTS

Physically backed ETFs are effective products for gaining spot price exposure to precious metals. Investors seeking exposure to other commodity sectors, however, are limited to futures-based products and natural resources companies because of storage challenges. Although neither futures-based commodity products nor natural resources companies are likely to provide returns that perfectly correlate with spot price returns over long-term periods, both types of products can potentially benefit during periods of rising commodity prices.

A primary drawback with futures-based products is the roll cost associated with rolling contracts, which can erode total returns during periods of contango. Natural resources companies, on the other hand, don’t have these structural issues, which can create higher total return potential. Still, natural resources companies are likely to have higher correlations with the broader equity markets compared to futures-based commodity products. For more information about investing in commodities, please reach out to our office.

Sources: Bloomberg, CAIA Association, Credit Suisse, U.S. Energy Information Administration (EIA), Investopedia, ETF Securities

Investments involve risk, including loss of principal amount invested. The commodities industries can be significantly affected by commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions. Past performance is no guarantee of future results. The precious metals market is speculative, unregulated, and volatile, and prices for these items may rise or fall over time. These investments may not be suitable for all investors, and there is no guarantee that any investment will be able to sell for a profit in the future. Investing in futures involves speculation, and the risk of loss can be substantial. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Emerging market investments involve higher risks than investments from developed countries and also involve increased risks due to differences in accounting methods, foreign taxation, political instability, and currency fluctuation. Mutual funds involve risk, including possible loss of amount invested. An exchange-traded fund (ETF) is similar to a mutual fund that tracks a specific stock or bond index, such as the Barclays Capital 1–3 Year Treasury Index. ETFs trade on one of the major stock markets and can be bought and sold throughout the trading day, like a stock, at the current market price. And, like stock investing, ETF investing involves principal risk (i.e., the chance that you won’t get all the money back that you originally invested), market risk, underlying securities risk, and secondary market price. An exchange-traded note (ETN) is a senior unsecured debt obligation designed to track the total return of an underlying market index or other benchmark, minus investor fees. The creditworthiness of an ETN is based on the creditworthiness of the issuer. The trading price of the ETN in the secondary market may be adversely impacted if the issuer’s credit rating is downgraded. Other ETNs may have call features that allow the issuer to call the ETN at the issuer’s discretion due to the occurrence of certain market events. A call right by an issuer may adversely affect the value of the notes.

The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. All indices are unmanaged and investors cannot invest directly into an index.

Mutual funds, ETFs, and ETNs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information, can be obtained by calling your financial advisor. Please read it carefully before you invest.

Follow this link for additional articles on commodities.

###

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

Authored by the Investment Research team at Commonwealth Financial Network.

© 2021 Commonwealth Financial Network®

Back To Blog