Commercial Real Estate Investments

Presented by Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®:

When most investors think about investing in real estate, their primary residence or residential real estate comes to mind. But there’s another investing opportunity available: commercial real estate. This includes the ownership or partial ownership of the office properties people work in, the retail properties people shop in, and the hotels people stay in when they travel. The concept may seem unattainable, but as part of your wealth management plan, it is more accessible than you may think.

Why invest in commercial real estate

Many property investors invest in commercial real estate to help:

- Diversify a portfolio

- Generate potential total returns

- Hedge against inflation

Diversify a portfolio

Asset allocation—the act of distributing assets among different asset classes (e.g., stocks, bonds, and cash equivalents)—is a main tenet of modern portfolio theory. By investing in a diversified portfolio of assets with historically low correlations (i.e., they were less likely to perform similarly through various market cycles), an investor may be able construct a portfolio that generates higher risk-adjusted returns. In other words, through diversification, an investor may be able to generate a certain level of returns with the lowest possible portfolio volatility. Of course, diversification does not assure a profit or protect against loss during a declining market.

Historically, commercial real estate has fit the bill of a portfolio diversifier and has become an important building block in many investor portfolios. As an asset class, commercial real estate may react differently to certain economic variables than traditional operating companies; thus, its returns may zig when other assets classes’ returns zag.

Generate total returns

Commercial real estate investment returns generally come from two sources: income and capital appreciation.

Income return is derived from the ongoing operations of the property or portfolio of properties. In most cases, the commercial property owners collect rents (revenue) and pay out financing and operating costs (expenses). The difference between the revenue and expenses may be passed on to the property owners in the form of an ongoing income yield.

Capital appreciation is measured as the difference between the initial investment (plus capital improvements) and the amount returned when an investment is sold. The ultimate outcome can be affected by property-specific factors (e.g., change in the property’s occupancy rate), location factors (e.g., new supply entering the market as the result of development), and/or macroeconomic factors (e.g., market capitalization rate changes due to a perceived change in the risk environment).

Hedge against inflation

While real estate has tended to be cyclical, commercial real estate has been considered an inflation hedge due to a number of factors. First, as the price of goods and services rises, so may the rental rates that property owners can charge tenants. Second, replacement cost is a significant factor in determining when new development occurs. As construction and material costs increase due to inflation, existing properties may also rise in value before additional competitive supply is added to the market. And third, due to commercial real estate’s high percentage of capital or fixed assets, inflationary pressures (which tend to affect variable inputs like labor costs) have tended to have a limited effect on the expense side of a real estate portfolio’s income statement.

Is investing in commercial property a good idea?

Only a couple of decades ago, the ability to invest in commercial real estate was restricted to a few very wealthy individuals, pension funds, endowments, and the like. Securitization has allowed investors to pool their capital together to invest in commercial properties. The democratization of commercial real estate has gone a long way to increase the accessibility of the asset class and has allowed for the creation of the many commercial real estate investment options now available to investors.

The commercial real estate investment universe can be sliced and diced in unlimited fashion. We are going to start by separating the investment universe into two mutually exclusive categories: traded and nontraded.

Traded investment vehicles

As the name implies, traded commercial real estate investment vehicles include entities that are traded on a national exchange. Imagine a company whose main business is owning and operating a portfolio of office properties. The shares of that company may be floated on a national exchange for investors to buy and sell, just as they might buy and sell shares of any stock.

Most of the traded companies that concentrate in the ownership of commercial real estate assets are structured as real estate investment trusts, or REITs. REITs are companies that hold particular types of assets and do not pay corporate-level taxes as long as the entity remains in compliance with certain requirements. The REIT structure was originally created in 1960 and later modified in 1986, which is often thought of as the birth of the modern REIT era. Similar tax structures to the REIT currently exist in a number of countries, including Australia, Malaysia, the United Kingdom, France, and Japan.

REIT mutual funds and REIT exchange-traded funds (ETFs) are actively or passively managed portfolios of traded REITs. In essence, if investors do not have the economic means or experience to buy and manage their own portfolios of commercial real estate, they can buy shares in a traded REIT. And if investors do not have the time or desire to build and manage their own portfolios of traded REITs, they can pay an investment manager to do so for them.

Traded REITs, REIT mutual funds, and REIT ETFs are readily accessible vehicles that offer investors exposure to a portfolio of properties that are typically regionally diverse and possibly sector diverse as well. These investment vehicles are transparent, liquid, and cost-effective, but they have tended to be quite volatile and react to the daily emotions of the financial markets.

Nontraded investment vehicles

Nontraded commercial real estate investment vehicles (often referred to as direct participation programs) are companies that do not trade on a national exchange. The building blocks of these companies are often quite similar to that of their traded brethren in that they own a portfolio of commercial real estate properties, and investors can purchase interests in the company.

Direct participation programs are considered a direct real estate investment or an investment in the private real estate markets. The goal is to attain an investment with commercial real estate characteristics as opposed to an asset with financial market characteristics. Many institutional investors satisfy their direct commercial real estate investment allocation by buying properties outright. Nontraded REITs and real estate-focused limited partnerships are vehicles created to provide retail investors, who cannot afford to purchase their own portfolio of properties, a similar dynamic. These vehicles have historically tended to exhibit low volatility and low correlation to the financial markets, but they also have tended to lack liquidity, have long holding periods, and may have inefficient fee structures.

How to get started in commercial investing

Once an investor decides whether to invest in a traded real estate investment vehicle, a nontraded real estate investment vehicle, or a combination of the two, the next step is to examine the underlying assets, which can be broken down by position in the capital structure, location, property type, and risk level.

Consider your underlying assets

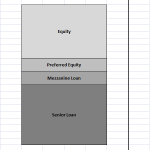

Position in capital structure. Similar to traditional operating companies, commercial real estate investment companies attempt to build a capital structure that can maximize the return to the investors. As a result of the continued evolution of the securitization industry, retail investors now have the ability to invest in almost all layers of the commercial real estate capital structure.

The senior loan is the first party to receive payment from the property’s cash flow; it also has the first call on any collateral. This has tended to be the lowest risk/return portion of the capital structure.

Next in the line of seniority are the B-note, mezzanine lender, and preferred equity investors. These passive investors are generally income-focused, but they take on more risk than the senior lender.

Finally, the most junior member of the capital stack is the equity investor. This is the active investor and the highest risk/highest potential return investment position.

Why location is important

“Location, location, location” may be one of the most common phrases used in real estate, but it is prevalent because of its importance. As potential investors in real estate portfolios, we most likely will not be able to visit and examine each property in an applicable portfolio, but, at a minimum, it is important to understand the location theme behind our investments and the positives and negatives that come with that theme.

- Domestic or global: One of the most significant themes behind any real estate investment vehicle is whether the entity owns properties exclusively in the United States or whether properties are owned on a global basis. The benefits of investing on a global basis can include additional diversification, as well as exposure to potentially vibrant economies. With these potential benefits, however, come geopolitical and currency risks.

- Primary, secondary, and tertiary markets: Primary markets include the likes of New York and San Francisco. Secondary markets include the likes of Denver and Phoenix. Tertiary markets include the likes of Reno and Manchester. As we move from primary markets down to tertiary markets, investors move further out on the risk spectrum for the potential of higher returns.

Primary property markets are often thought of as international gateways and are expected to have higher liquidity, more demand drivers, and a greater availability of potential tenants. On the other hand, tertiary markets can be very dependent on a single industry, and it may take more time to find potential purchasers of properties.

6 major commercial property types

Commercial real estate includes the places people sleep, work, and shop, as well as the properties that support consumer-facing activities. The asset class can be broken into six major property types:

- Industrial. This includes industrial parks, light and heavy manufacturing buildings, distribution facilities, and research and development parks. These are the properties that support consumer-facing activities and are often found near ports, airports, and distribution networks.

- Lodging. This includes hotels, resorts, and extended-stay facilities. These properties tend to have the shortest lease terms (hotel room rates change daily!); as such, they have greater risks but the potential of higher return.

- Multifamily. This includes high-rise apartments, garden-style apartments, and duplexes. These properties tend to have shorter lease terms (month-to-month, semiannual, annual) and are currently blessed with the availability of government agency financing options.

- Office. This includes high-rise and low-rise properties. Office properties tend to be characterized by their location in a particular metropolitan area as a central business district or a suburban office property. Office properties tend to have longer lease terms, but they can be plagued by high tenant improvement costs.

- Retail. This includes freestanding stores, grocery-anchored shopping centers, and power centers. These are the locations where consumers shop for their goods; as a result, accessibility and surrounding demographics are very important. An important theme in this space is the future of Internet shopping.

- Other. This includes a number of unique property types, including data storage, health care, and self-storage. Each of these areas has its own demand drivers. For instance, the future of cloud computing will affect data storage properties, while the health of single-family housing will affect self-storage.

The level of risk in commercial real estate investments

There are a number of nuances that affect the risk/return profile of a particular property. Lease structure, tenant quality, and financing strategy are just some of these factors. In order to reflect risk levels, commercial real estate investments are often grouped in one of four categories:

- Core properties tend to be lower risk/return vehicles. Core properties are characterized by low vacancy, long-term leases to creditworthy tenants, and strong locations. An investor purchases core real estate to seek income.

- Core-plus properties lie further out on the risk/return spectrum than core properties. These properties are mostly stable but have some factors that increase the property risk. An investor purchases core-plus real estate to seek income, with capital appreciation as a secondary objective.

- Value-add real estate takes us one step further out on the risk/return spectrum. These properties tend to require a repositioning effort. An investor purchases value-add real estate to seek capital appreciation, with income as a secondary consideration.

- Opportunistic real estate is the most aggressive of the existing property types. These properties require a major repositioning effort and may involve other extenuating circumstances. An investor purchases opportunistic real estate to seek capital appreciation. It has the greatest risks.

Overall, there are many ways to invest in commercial real estate, and, due to the continued evolution of the space, there are a significant number of options available to retail investors. Some investors may choose to focus on investing in the preferred equity of a traded REIT with a concentration of core office properties located in Boston and New York City. Others may be interested in a nontraded limited partnership with a portfolio of core-plus retail properties located throughout the United States.

Most investors, however, tend to focus on the attributes that a general commercial real estate allocation can add to their existing portfolios—diversifying a portfolio, generating potential total returns, and providing a hedge against inflation. These investors will look to a diversified REIT mutual fund, REIT ETF, or nontraded REIT, or a combination of the three, to provide them with these benefits.

As your financial advisor, we can be a valuable resource in helping to target the commercial real estate investment vehicle that suits your needs. Please contact us if you would like to discuss the options available.

Disclosure: Certain sections of this commentary contain forward-looking statements that are based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. All indices are unmanaged and investors cannot invest directly into an index. Real estate investments are subject to a high degree of risk because of general economic or local market conditions; changes in supply or demand; competing properties in an area; changes in interest rates; and changes in tax, real estate, environmental, or zoning laws and regulations. REIT units/shares fluctuate in value and may be redeemed for more or less than the original amount invested. Risks of international investing include currency fluctuations; differences in accounting methods; foreign taxation; economic, political or financial instability; lack of timely or reliable information; or unfavorable political or legal developments. These risks are magnified in emerging markets. Mutual fund shares are subject to risk. Investment return and principal value will fluctuate and shares redeemed may be worth more or less than the original amount invested.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. You should consult a tax preparer, professional tax advisor, and/or a lawyer regarding your individual situation.

Please consider the investment objectives, risks, charges and expenses carefully before investing. The prospectus, which contains this and other information, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

###

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

Authored by Chad LaFauci, CFA®, manager, real assets, at Commonwealth Financial Network.

Look for additional articles on this topic.

© 2019 Commonwealth Financial Network®

Back To Blog