Choosing a Business Entity

Presented by Kris Maksimovich, AIF®, CRPC®, CPFA®, CRC®:

Whether you’ve been in business for years or you’re launching a start-up, choosing or changing your business entity is an important part of its financial and overall future.

A business’s entity determines the rules that govern its formation, operation, taxation, and dissolution. Its entity also establishes the degree to which the business and its investors are liable for the acts of an agent of the business. The entity you choose for your business will affect future financial business decisions, like the need for additional insurance to protect yourself against liability or the decision to sell ownership interests.

What are the deciding factors when determining the entity type for your business?

When choosing an entity for your business, you will want to consider the attributes of each type of entity and which best fits your vision for the business. There are seven primary entity attributes:

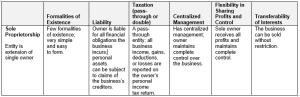

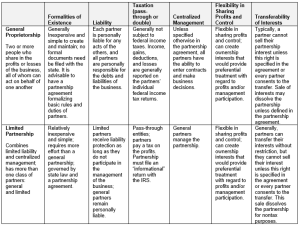

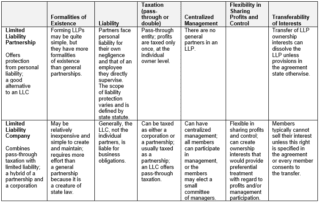

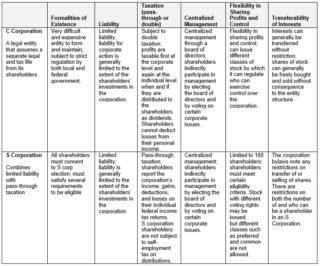

1) Formalities of existence. There are certain requirements and procedures involved in forming and maintaining the entity. The fewer formalities of existence, the simpler and less expensive the entity. So, if you want to avoid spending a lot of money forming or maintaining your business, consider an entity that has few formalities of existence.

2) Limited liability. An entity offers limited liability if an owner can lose nothing more than their investment. In other words, the owner’s personal assets are insulated and cannot be used to satisfy the entity’s liabilities (debts). If you do not wish to put all of your personal assets at risk, think about an entity that offers limited liability.

3) Pass-through taxation. In a pass-through entity, only the owners are taxed, not the entity. A separate taxpaying entity, on the other hand, may be taxed on the same profits twice; the entity is taxed on its profits, and then the shareholders are taxed when (or if ) these profits are distributed to them as dividends. This is known as double taxation, and its existence is the main reason business owners choose a pass-through entity. If you plan to have the profits of the business distributed as soon as they are earned, or if you want a business that will permit you to deduct business losses from your personal income, consider a pass-through entity.

4) Centralized management. An entity has centralized management if a person or a relatively small group of people is responsible for management decisions. If you plan to give only a few people decision-making power, which usually results in quicker decisions, choose an entity with centralized management.

5) Flexibility in sharing profits and control. Some entities are more flexible than others in sharing profits and control with their owners. Depending on the flexibility, an entity can sell its stock to any willing buyer, issue classes of stock with differing rights regarding the distribution of corporate profits to shareholders, or issue stock with different voting rights. If you want to have control over how profits are distributed and who has control over the corporation, you should choose an entity that allows you this control.

6) Continuity of life. Some entities can exist forever. This is called continuity of life. An entity does not possess this attribute if the death, bankruptcy, retirement, insanity, or resignation of an owner can cause it to end (dissolve). Continuation of the business can be planned for, so while this isn’t necessarily a real problem, it is something you should be aware of and consider.

7) Free transferability of interests. You should consider the ease with which ownership interests may be transferred. Free transferability of interests exists when owners are permitted to sell their ownership interests to others without restriction.

What are the most common types of business entities?

Sole proprietorship. The most straightforward way to structure your business entity, a sole proprietorship is easy to set up—no separate entity must be formed. The business is simply an extension of the sole proprietor.

Partnerships. If two or more people own a business, then a partnership is a viable option to consider. Partnerships are organized in accordance with state statutes. Certain arrangements, however, like joint ventures, may be treated as partnerships for federal income tax purposes, even if they do not comply with state law requirements.

A partnership may not be the best choice of entity for a business that anticipates an initial public offering (IPO) in the near future. Although there are publicly traded partnerships, most IPO candidates are organized as corporations.

Corporations. Corporations offer some advantages over sole proprietorships and partnerships, but they also come with drawbacks. The two most important advantages are that corporations provide the greatest shield from individual liability and are the easiest type of entity to use to raise capital and to transfer interests. (The majority stockholder can usually sell his or her stock without restrictions.) Corporations are generally subject to federal income tax, however, so the distributed earnings of your incorporated business may be subject to corporate income tax, as well as individual income tax.

How You Choose the Best Form of Business Ownership

There is no single best form of ownership for a business. Often, the limitations of a particular form of ownership can be compensated for through other means. For instance, insurance can reduce liability exposure if the chosen entity does not provide this kind of protection. Even after you have established your business as a particular entity, you may want to reevaluate your choice as the business evolves. We can work with an experienced attorney and tax advisor to help you decide which form of ownership is best for your business.

This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer.

###

Kris Maksimovich is a financial advisor located at Global Wealth Advisors 4400 State Hwy 121, Ste. 200, Lewisville, TX 75056. He offers securities and advisory services as an Investment Adviser Representative of Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser. Financial planning services offered through Global Wealth Advisors are separate and unrelated to Commonwealth. He can be reached at (972) 930-1238 or at info@gwadvisors.net.

© 2021 Commonwealth Financial Network®

Back To Blog